Variable and tracker rates not being increased by the bank.

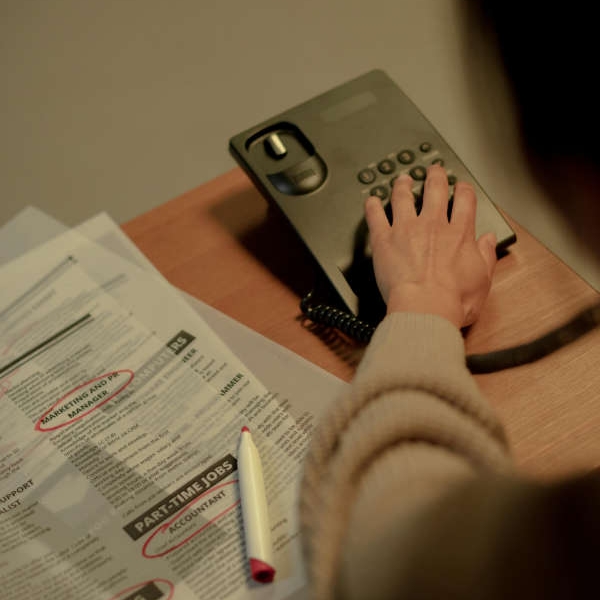

AIB has become the first of the three main banks to increase its mortgage rates in the wake of European rises.

The higher fixed rates are across the AIB, EBS and Haven brands, pushing up the cost of repayments on some fixed rates by €300 a year.

The 0.5 per cent rise will apply from the end of today to new customers on fixed and variable rates.

However, it won't apply to borrowings drawn down before November 14th.

AIB said the rises are in response to the European Central Bank’s ( ECB) decisions to raise interest rates by 1.25 percentage points since July.

Darragh Cassidy from Bonkers-dot-ie says this is just the beginning for mortgage holders in Ireland:

Sharp Rise In M9 Collisions With Garda Call-Outs Up Year-On-Year

Sharp Rise In M9 Collisions With Garda Call-Outs Up Year-On-Year

Councillor Seeks Clarity On How Often Nightclubs and Late Bars In Naas Are Inspected For Fire Risks

Councillor Seeks Clarity On How Often Nightclubs and Late Bars In Naas Are Inspected For Fire Risks

New Figures From CSO Reveal How Much International Protection Applicants Earn Compared To Average Worker In Ireland

New Figures From CSO Reveal How Much International Protection Applicants Earn Compared To Average Worker In Ireland

Unpaid Eight-Month Work And Training Placement For Adults With Disabilities Branded "Extremely Unfair"

Unpaid Eight-Month Work And Training Placement For Adults With Disabilities Branded "Extremely Unfair"

Department Of Education Defends Kildare SNA Cuts Amid Claims Of Reduced Need At Some Schools

Department Of Education Defends Kildare SNA Cuts Amid Claims Of Reduced Need At Some Schools

Naas Nurses Threaten Escalation As Staffing Row Deepens

Naas Nurses Threaten Escalation As Staffing Row Deepens

Driving Tests Face Disruption As RSA Testers To Strike Next Week

Driving Tests Face Disruption As RSA Testers To Strike Next Week

Jury Delivers Not Guilty By Reason Of Insanity Verdict In Ballyfin Demesne Strangling Case

Jury Delivers Not Guilty By Reason Of Insanity Verdict In Ballyfin Demesne Strangling Case