It warns that Ireland has 'little margin of error' in dealing with cost-of-living crisis.

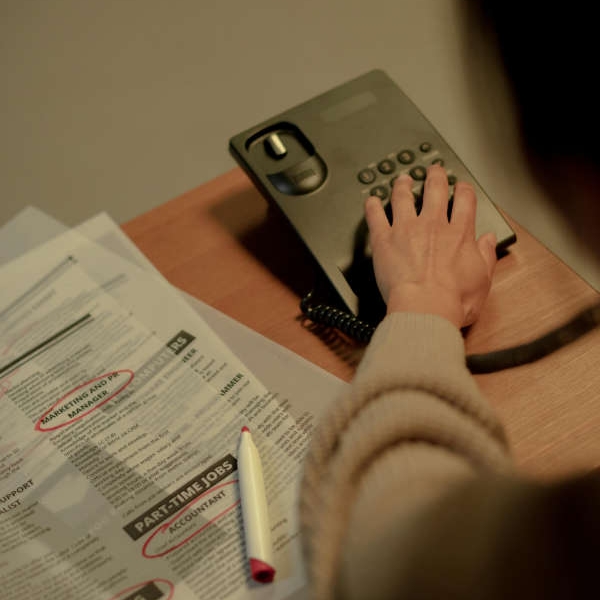

As much as €9 billion or 60% of the Government’s corporate tax take may be “temporary”, meaning it cannot be counted on in the future, the Irish Fiscal Advisory Council (Ifac) has said.

In its latest report, the financial watchdog said the Government’s over-reliance on volatile and vulnerable corporation tax receipts posed a significant threat to the public finances and needed to be reduced as a matter of urgency.

This means the money couldn't be explained by the performance of the domestic economy and it's an unreliable source of income for the state.

It suggested the Government could unwind this over-reliance by rebuilding the so-called rainy day fund or by paying down debt.

The Government have been warned to reduce our reliance on corporation tax and find other revenue raising taxes that are more consistent.

The chairman of IFAC Sebastian Barnes says other ways of generating tax need to be explored while phasing out our dependence on corporations:

Sharp Rise In M9 Collisions With Garda Call-Outs Up Year-On-Year

Sharp Rise In M9 Collisions With Garda Call-Outs Up Year-On-Year

Councillor Seeks Clarity On How Often Nightclubs and Late Bars In Naas Are Inspected For Fire Risks

Councillor Seeks Clarity On How Often Nightclubs and Late Bars In Naas Are Inspected For Fire Risks

New Figures From CSO Reveal How Much International Protection Applicants Earn Compared To Average Worker In Ireland

New Figures From CSO Reveal How Much International Protection Applicants Earn Compared To Average Worker In Ireland

Unpaid Eight-Month Work And Training Placement For Adults With Disabilities Branded "Extremely Unfair"

Unpaid Eight-Month Work And Training Placement For Adults With Disabilities Branded "Extremely Unfair"

Department Of Education Defends Kildare SNA Cuts Amid Claims Of Reduced Need At Some Schools

Department Of Education Defends Kildare SNA Cuts Amid Claims Of Reduced Need At Some Schools

Naas Nurses Threaten Escalation As Staffing Row Deepens

Naas Nurses Threaten Escalation As Staffing Row Deepens

Driving Tests Face Disruption As RSA Testers To Strike Next Week

Driving Tests Face Disruption As RSA Testers To Strike Next Week

Jury Delivers Not Guilty By Reason Of Insanity Verdict In Ballyfin Demesne Strangling Case

Jury Delivers Not Guilty By Reason Of Insanity Verdict In Ballyfin Demesne Strangling Case