It's reported revenue has already written off €26milllion.

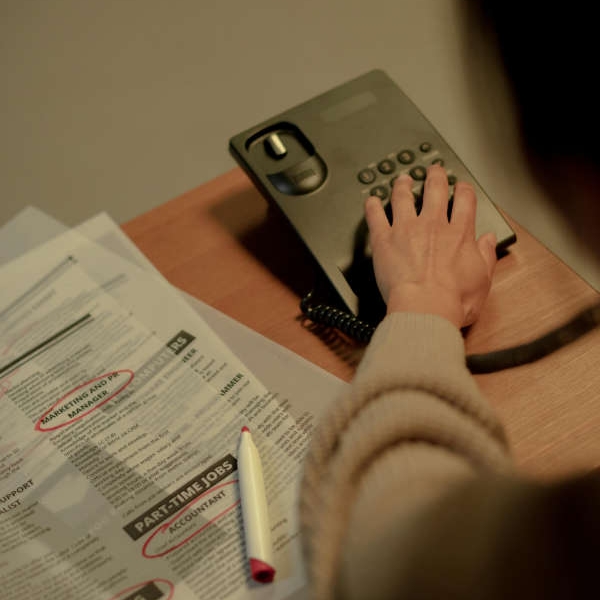

The state is owed almost €2.9 billion in unpaid tax by businesses who struggled during the Covid pandemic.

Over 26 million has already been written off by Revenue.

The Tax Debt Warehousing Scheme was announced by the government in May 2020, at the height of Covid restrictions.

It was aimed at supporting businesses who suffered a downturn due to the pandemic.

It allowed them to defer paying tax liabilities until they were able to deal with them.

256,000 businesses were eligible - and their combined debt was nearly 32 billion euro.

Finance Minister Paschal Donohoe has said 91% of that has been paid back to Revenue, but that leaves 2.9 billion euro outstanding.

Revenue has already written off €26.4 million euro in warehoused debt for companies that have been liquidated since the start of the scheme.

Sharp Rise In M9 Collisions With Garda Call-Outs Up Year-On-Year

Sharp Rise In M9 Collisions With Garda Call-Outs Up Year-On-Year

Councillor Seeks Clarity On How Often Nightclubs and Late Bars In Naas Are Inspected For Fire Risks

Councillor Seeks Clarity On How Often Nightclubs and Late Bars In Naas Are Inspected For Fire Risks

New Figures From CSO Reveal How Much International Protection Applicants Earn Compared To Average Worker In Ireland

New Figures From CSO Reveal How Much International Protection Applicants Earn Compared To Average Worker In Ireland

Unpaid Eight-Month Work And Training Placement For Adults With Disabilities Branded "Extremely Unfair"

Unpaid Eight-Month Work And Training Placement For Adults With Disabilities Branded "Extremely Unfair"

Department Of Education Defends Kildare SNA Cuts Amid Claims Of Reduced Need At Some Schools

Department Of Education Defends Kildare SNA Cuts Amid Claims Of Reduced Need At Some Schools

Naas Nurses Threaten Escalation As Staffing Row Deepens

Naas Nurses Threaten Escalation As Staffing Row Deepens

Driving Tests Face Disruption As RSA Testers To Strike Next Week

Driving Tests Face Disruption As RSA Testers To Strike Next Week

Jury Delivers Not Guilty By Reason Of Insanity Verdict In Ballyfin Demesne Strangling Case

Jury Delivers Not Guilty By Reason Of Insanity Verdict In Ballyfin Demesne Strangling Case